Kisan Card Program Gets Major Update

The Kisan Card Program in Punjab, Pakistan, is a groundbreaking initiative designed to empower farmers financially by offering interest-free loans and subsidies for purchasing agricultural essentials like seeds, fertilizers, and pesticides. This guide explains the complete application process, eligibility criteria, required documents, and the benefits of using a Kisan Card. Primarily targeting small to medium landholders, the program aims to enhance agricultural output and improve the livelihoods of farmers in Punjab.

Register Now for Punjab Minority Card

This initiative is part of Punjab’s broader effort to support the agriculture sector, ensuring farmers can meet their financial and operational needs effectively.

Quick Information Table

| Details | Information |

|---|---|

| Program | Kisan Card Scheme |

| Start Date | June 2024 |

| End Date | Ongoing |

| Assistance Amount | Up to PKR 150,000 per cycle |

| Application Method | Online/SMS and Tehsil Office |

What is the Kisan Card Program?

The Kisan Card Program is an initiative by the Punjab government to provide financial support and grants to farmers, enhancing farming efficiency. Through this program, farmers gain access to interest-free loans and government-subsidized farming inputs such as seeds and fertilizers. This initiative simplifies access to financial resources, reduces operational costs, and increases farmers’ incomes, making it a lifeline for Pakistan’s agricultural sector.

Get Started with Electric Bike Registration

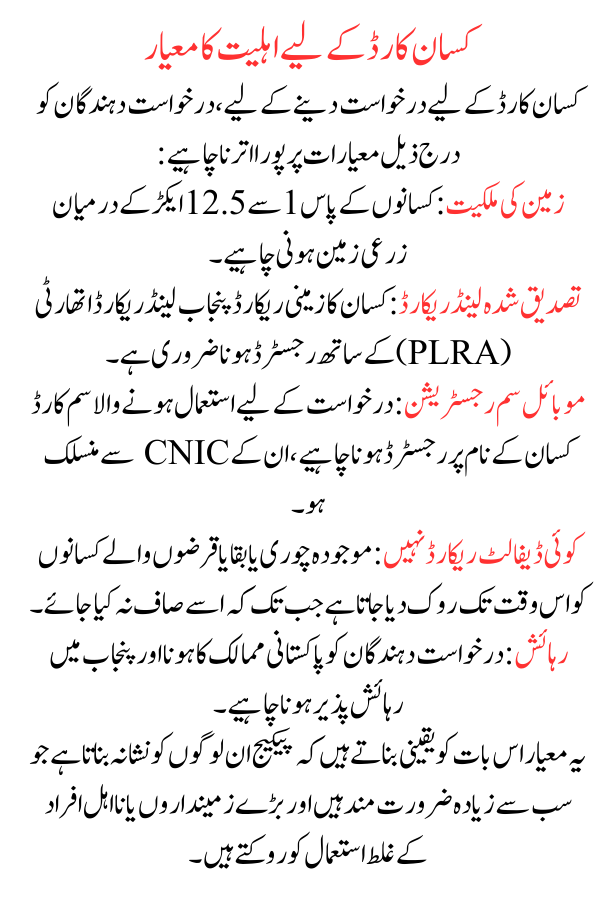

Eligibility Criteria for the Kisan Card

To qualify for the Kisan Card, applicants must meet these criteria:

- Land Ownership: Farmers must own 1 to 12.5 acres of agricultural land.

- Verified Land Record: The farmer’s land must be registered with the Punjab Land Record Authority (PLRA).

- Mobile SIM Registration: The SIM card used for the application must be registered in the farmer’s name and linked to their CNIC.

- No Default Record: Applicants must not have any outstanding loans.

- Residency: Applicants must be Pakistani citizens residing in Punjab.

These criteria ensure that the program reaches small-scale farmers who need support the most.

Explore Livestock Card Services in Punjab

Required Documents for Kisan Card Application

Farmers should gather the following documents before applying:

- CNIC: A valid National Identity Card.

- Proof of Land Ownership: Documentation showing ownership of 1–12.5 acres.

- Kisan Passbook (if available): Useful for additional verification.

- Bank Account Details: Necessary for loan disbursements and subsidies.

- Registered SIM: A mobile number registered under the applicant’s CNIC.

- Proof of Residency: Utility bills (electricity or water) for address verification.

These documents are verified by NADRA, PLRA, and other authorities to confirm eligibility and minimize fraud risks.

Check Ehsaas Amdan Program CNIC Online Registration

How to Apply for the Kisan Card

Farmers can apply for the Kisan Card through multiple channels:

- SMS Registration:

- Send an SMS to 8070 in the format:.

PKC [space] CNIC Number - A confirmation message will provide further instructions.

- Send an SMS to 8070 in the format:.

- In-Person Registration:

- Visit the nearest Tehsil Agriculture Office.

- Present the required documents and complete the application process.

- Online Registration:

- Use the Punjab Agriculture Department’s portal to upload required documents and follow instructions.

- Verification and Mobile Wallet Creation:

- After registration, create a mobile wallet via HBL Konnect or an approved service.

- This wallet will link to the Kisan Card for easy fund access.

Discover Punjab Minority Card Registration Details

How to Use the Kisan Card

Once issued, the Kisan Card provides access to the following benefits:

- Interest-Free Loans: Farmers can secure loans up to PKR 150,000 per cycle or PKR 30,000 per acre.

- Subsidies on Inputs: Discounts on seeds, fertilizers, and pesticides reduce production costs.

- Repayment Structure: Loans are repayable over six months, allowing eligibility for new loans after repayment.

Benefits of the Kisan Card

The program is designed to empower farmers through

- Financial Assistance: Easy access to interest-free loans for operational costs.

- Transparency: Digital processes reduce fraud and ensure benefits reach the right farmers.

- Efficiency: A streamlined application and fund delivery process ensures timely resource availability.

- Increased Productivity: Reduced input costs and financial stability allow for better farming practices and higher yields.

Register for Electric Bike Program Now

Updated Information

As of December 27, 2024, the Punjab government has expanded the Kisan Card program to include additional benefits such as

- Enhanced loan limits for progressive farmers.

- Additional subsidies for adopting climate-smart agricultural practices.

- Digital support through a dedicated mobile app for cardholders.

This update ensures broader inclusivity and maximizes the program’s impact on Pakistan’s agriculture sector.

Read More

FAQs

1. How long does it take to receive the Kisan Card after registration? Typically, it takes a few days after successful registration and verification.

2. What happens if my land record is not registered with the PLRA? You must register your land with the Punjab Land Record Authority to qualify.

3. Are there any fees for the Kisan Card? No, the card is free; however, minor service charges may apply for specific services like mobile wallet setup.

4. Can I apply for multiple loans in a year? Yes, loans are available per crop cycle. You can apply for a new loan upon repaying the previous one.

5. Are tenant farmers eligible for the program? Only landowners with 1–12.5 acres are eligible. Tenant farmers are not included.

6. What is the maximum loan amount? Farmers can receive up to PKR 150,000 per cycle.

7. Can I use the Kisan Card outside Punjab? No, the program is limited to residents of Punjab.

8. What are the repayment terms for loans? Loans are repayable within six months of disbursement.

9. How are subsidies applied? Subsidies are automatically deducted during the purchase of approved agricultural inputs.

10. What happens if I default on loan repayment? Defaulters may lose access to future loans and face legal consequences.

The Kisan Card Program continues to be a transformative initiative for Punjab’s farming community, promoting financial stability and sustainable agricultural growth.