BISP Payment Phase 2 Bank System

The Benazir Income Support Programme (BISP) is one of Pakistan’s largest social safety initiatives, providing financial assistance to underprivileged families. With the rollout of BISP Payment Phase 2, the system has been modernized by incorporating banking networks for a more transparent and efficient distribution process. This article provides an in-depth look at Phase 2 of the BISP Payment System, focusing on clusters, authorized banks, procedures, common issues, and their solutions.

Read Also:53 Lakh Patients Treated in Punjab

Quick Information Table

| Field | Details |

|---|---|

| Start Date for Application | January 2025 |

| Last Date for Application | March 2025 |

| Eligibility Criteria | Existing BISP beneficiaries with valid CNIC |

| Required Documents | CNIC, biometric verification |

| Official Website | https://www.bisp.gov.pk/ |

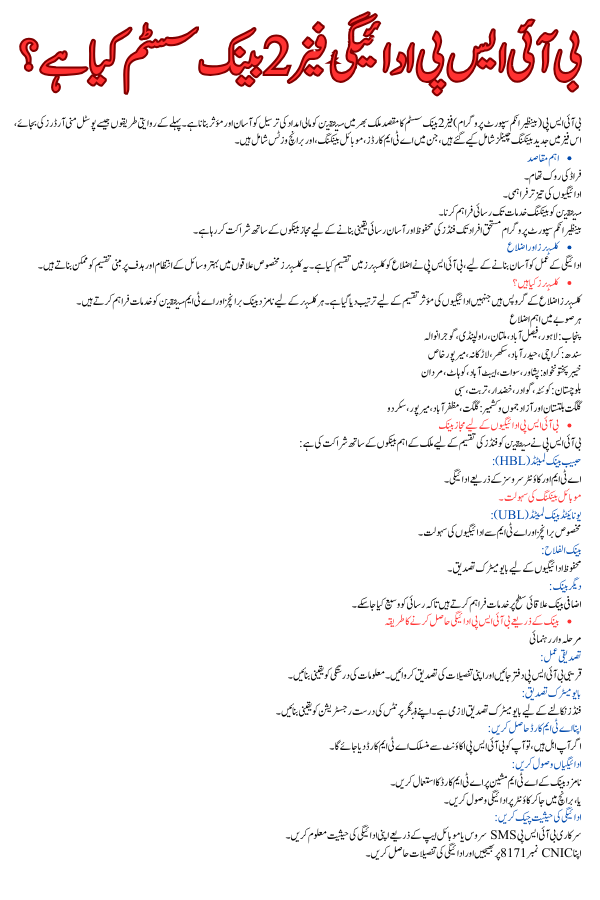

What is the BISP Payment Phase 2 Bank System?

The BISP Payment Phase 2 Bank System aims to streamline the disbursement of financial aid to millions of beneficiaries across Pakistan. Instead of relying solely on traditional methods such as postal money orders, this phase integrates modern banking channels, including ATM cards, mobile banking, and branch visits.

The purpose is to reduce fraud, ensure faster delivery of payments, and provide beneficiaries with access to banking services. By collaborating with authorized banks, BISP ensures secure and convenient access to funds for those who need them most.

Read Also:Sindh Govts decision to issue Kisan Card across the province

Clusters and Districts

To ensure smooth operations, BISP has divided its payment distribution process into clusters based on districts. These clusters allow targeted distribution and better management of resources.

What are Clusters?

Clusters are groups of districts categorized for efficient processing and payment distribution. Each cluster has designated bank branches and ATMs to serve the beneficiaries.

Key Districts in Each Province

Here’s an example of how clusters are distributed:

- Punjab: Lahore, Faisalabad, Multan, Rawalpindi, Gujranwala

- Sindh: Karachi, Hyderabad, Sukkur, Larkana, Mirpurkhas

- Khyber Pakhtunkhwa: Peshawar, Swat, Abbottabad, Kohat, Mardan

- Balochistan: Quetta, Gwadar, Khuzdar, Turbat, Sibi

- Gilgit-Baltistan and AJK: Gilgit, Muzaffarabad, Mirpur, Skardu

Authorized Banks for BISP Payments

The BISP program has partnered with leading banks to facilitate the distribution of funds. Here are the authorized banks handling BISP Phase 2 payments:

- Habib Bank Limited (HBL):

- Offers BISP payments via ATMs and over-the-counter services.

- Provides mobile banking for easier access.

- United Bank Limited (UBL):

- Facilitates payments through designated branches and ATM withdrawals.

- Bank Alfalah:

- Assists with biometric verification for secure payment disbursement.

- Other Partner Banks: Additional banks may participate regionally to ensure wider accessibility.

Read Also: Chief Minister Youth Skills Development Program 2024

How to Receive BISP Payments via Banks

Step-by-Step Guide for Beneficiaries

- Verification Process:

Visit the nearest BISP office to verify your details and ensure your information is up-to-date. - Biometric Verification:

Biometric authentication is mandatory for withdrawing funds. Ensure your fingerprints are correctly registered. - Collect Your ATM Card:

If eligible, you will receive an ATM card linked to your BISP account. - Withdraw Payments:

- Use the ATM card at the designated bank’s ATM machines.

- Alternatively, visit the bank branch for over-the-counter payments.

- Check Payment Status:

- You can check your payment status via the official BISP SMS service or mobile app.

- Send your CNIC number to 8171 to receive payment details.

Read Also: Sindh Government Solar System Initiative

Common Issues and Solutions

Despite the improved system, beneficiaries may face challenges while withdrawing payments. Here are some common issues and their solutions:

1. Biometric Verification Failure

- Problem: Fingerprint recognition fails due to technical or physical issues.

- Solution: Visit the NADRA office to update your biometric records.

2. ATM Card Lost or Damaged

- Problem: Beneficiaries lose their cards, or the cards are damaged.

- Solution: Report the issue to the BISP helpline and request a replacement card.

3. Delayed Payments

- Problem: Payments are delayed due to system or processing errors.

- Solution: Contact your district BISP office to file a complaint or inquire about payment status.

4. SMS Scams

- Problem: Fraudulent SMS claiming to be from BISP.

- Solution: Only trust official messages from 8171 and avoid sharing personal details with unknown sources.

Benefits of Using Banks for BISP Payments

The shift to bank-based payments offers several advantages:

- Transparency: Reduces fraud and ensures rightful beneficiaries receive payments.

- Convenience: Beneficiaries can access funds via ATMs or branches without waiting for postal deliveries.

- Financial Inclusion: Encourages the use of banking services among low-income households.

- Safety: Eliminates risks associated with carrying large sums of cash from post offices.

Important Guidelines for Beneficiaries

- Always carry your original CNIC when visiting the bank for payment.

- Keep your ATM card and PIN code confidential to prevent misuse.

- Regularly check your payment status via SMS or the official BISP portal.

- Avoid intermediaries and agents offering “help” in exchange for money.

Timeline for Phase 2 Payments

The exact timeline for BISP Payment Phase 2 Bank System varies across districts and clusters. Payments are generally disbursed quarterly, but beneficiaries are advised to check their payment schedule regularly through the SMS service or their local BISP office.

Read Also: Maryam Nawaz Sharif launched Zindagi Asan Program

Conclusion

The BISP Payment Phase 2 Bank System is a major step forward in providing financial assistance to Pakistan’s most vulnerable communities. By leveraging banking infrastructure, the program ensures transparency, efficiency, and accessibility.

If you’re a BISP beneficiary, make sure to update your details, follow the proper withdrawal procedures, and stay vigilant against scams. This initiative is not just about financial aid but also about empowering Pakistan’s underserved populations with access to banking and modern financial systems.