Ehsaas Nojawan Program Online Registration

TheEhsaas Nojawan Program Online Registration is a creativity by the Khyber Pakhtunkhwa (KP) government to provide interest-free and soft loans to Pakistani youth. The program aims to foster financial growth and tackle joblessness by supporting young entrepreneurs and skilled youth in launching or growing small and large businesses across KP. Through these loans, the government hopes to permit youth, improve economic permanence, and reduce poverty across the region. Ehsaas SMS Registration With New Method 2024

Quick Program Information Table

| Details | Information |

|---|---|

| Program Name | Ehsaas Nojawan Rozgar |

| Application Start Date | Expected early 2024; exact dates not yet announced |

| Application End Date | To be updated; applicants should check periodically on the official website |

| Eligibility | Pakistani youth aged 21-45, preferably residents of Khyber Pakhtunkhwa; applicants must demonstrate business viability |

| Required Documents | CNIC, business plan, proof of residency, and potentially a financial plan for large loans |

| Official Website | Ehsaas Program Official Portal |

Program Objectives and Goals

The Ehsaas Nojawan Program Online Registration has the following primary objectives:

- Youth Empowerment: Encourage and support the business potential of Pakistani youth.

- Poverty Reduction: Improve poverty through job creation and economic activity.

- Equitable Development: Ensure fair distribution of funds and chances across KP, particularly in small areas.

This program also includes special supplies for skill development and the promotion of financial freedom for young individuals with innovative business ideas. KPK Govt Launches 8 Big Scheme Apply Now

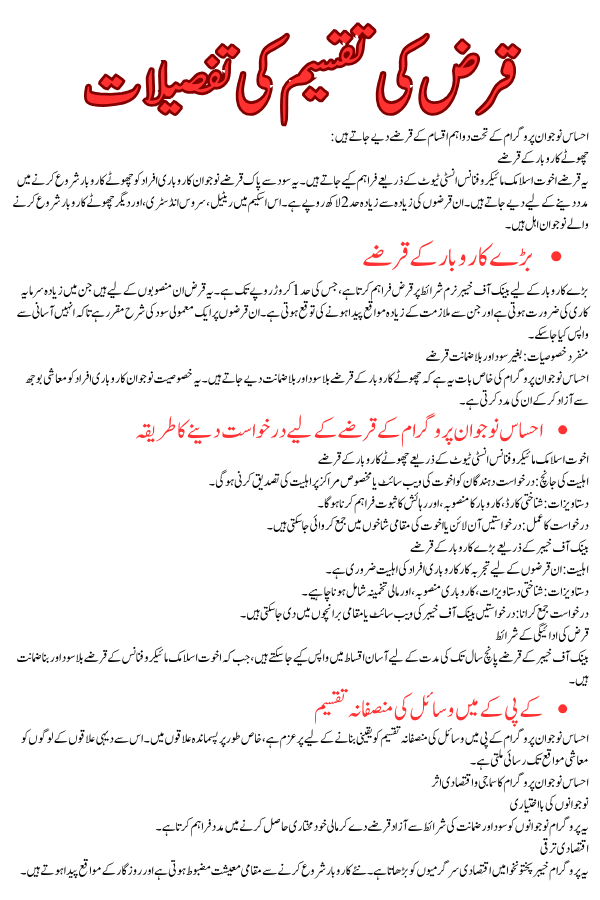

Loan Distribution Details

The Ehsaas Nojawan Program Online Registration offers two main types of loans:

- Small Business Loans: These are interest-free loans calculated for micro and small businesses.

- Large Business Loans: Soft loans with minimal interest, intended for larger ventures and projects requiring more large investment.

- Small Business Loans

The small business loans are managed by Akhuwat Islamic Microfinance Institute. These interest-free loans aim to help young magnates start small-scale businesses. The loan amount for small businesses is capped at Rs. 200,000. The scheme is nearby to a wide range of young Pakistanis who want to enter fields such as retail, service industry, and other small-scale businesses.

- Large Business Loans

For more recognized or larger-scale businesses, the Bank of Khyber provides soft loans of up to Rs. 10 million. These loans are geared towards schemes that require higher initial capital and are predictable to generate significant employment opportunities. Large business loans are slightly different in that they may involve a token interest rate, although specific terms are planned to be reasonable and kind. Chief Minister Youth Skills Development Program 2024

Unique Features: Interest-Free and Collateral-Free Loans

One standout feature of the Ehsaas Nojawan Rozgar Program is its interest-free, collateral-free loans for small businesses. This feature reduces the burden on young businesspersons by eliminating the risk related to typical bank loans, especially beneficial for those without significant assets.

How to Apply for Ehsaas Nojawan Program Loans

Applying for Small Business Loans through Akhuwat Islamic Microfinance Institute

- Eligibility Check: Applicants should verify eligibility criteria on the official Akhuwat website or through designated application centers.

- Documentation: Required documents typically include identification, proof of placement, and a viable business plan.

- Application Process: The application can be submitted either online or through Akhuwat’s local branches.

Applying for Large Business Loans through the Bank of Khyber

- Eligibility: Intended for more skilled business owners, applicants must provide certification demonstrating business feasibility.

- Documentation: Includes identity documents, business plans, and a financial projection.

- Application Submission: Applications can be made online through the Bank of Khyber’s website or at local branches.

Loan Repayment Terms

Bank of Khyber Loan Repayment

For large business loans, the Bank of Khyber offers supple payment terms based on the business’s capacity. Generally, these loans have a repayment period of up to 5 years, with terms designed to ease the financial burden on young magnates, allowing them to repay the loan in reasonable installments.

Akhuwat Islamic Microfinance Loan Repayment

Akhuwat’s small business loans are structured to be entirely interest-free with no security required. Repayment terms are customized to accommodate the cash flow of small businesses, confirming that young magnates are not overly loaded.

Equitable Allocation of Funds Across KPK

To ensure fair access to funds, the Ehsaas Nojawan Rozgar Program is devoted to reasonable division across KP. Special emphasis is placed on reaching youth in remote or frugally poor areas of the province. This approach is part of the broader government agenda to promote inclusive development and prevent movement from rural areas. Dhee Rani Program Registration 2024

Socio-Economic Impact of the Ehsaas Nojawan Program

Youth Empowerment

The Ehsaas Nojawan Rozgar Program is a practical step toward youth empowerment. By providing loans without interest or collateral requirements, it encourages young people to pursue free enterprise and become monetarily independent, breaking the cycle of poverty.

Economic Development

The program is expected to meaningfully boost economic activity in KP. By allowing new business ventures, it not only supports individual capitalists but also contributes to local economies by creating job opportunities. The focus on interest-free loans means young people are less monetarily restricted, and this, in turn, leads to greater economic output and resilience within communities.

Conclusion

The Ehsaas Nojawan Program Online Registration represents an important asset in the future of Pakistan’s youth, chiefly those in KP. By removing traditional financial barriers, it aims to foster a generation of authorized, monetarily independent youth who contribute meaningfully to the economy. The program’s emphasis on accessibility, fair distribution, and economic impact makes it a cornerstone of the direction’s youth development plan.