Interest-Free Ehsaas Loan Scheme

The Khyber Pakhtunkhwa (KP) Government has introduced the Interest-Free Ehsaas Loan Scheme to support small business owners and homeowners across the province. This initiative is a part of the government’s ongoing commitment to poverty alleviation and economic development. The scheme aims to provide interest-free loans to deserving individuals, enabling them to start or expand their businesses or improve their housing conditions.

Here’s a quick overview of the scheme for your convenience:

| Details | Information |

| Program Name | Interest-Free Ehsaas Loan Scheme |

| Start Date | January 15, 2024 |

| End Date | Ongoing (subject to fund availability) |

| Loan Amount | PKR 50,000 to PKR 500,000 |

| Application Method | Online and Offline |

Key Features of the Interest-Free Ehsaas Loan Scheme

This program has been designed to provide financial relief to individuals who lack access to formal banking services. Below are the key features of the scheme:

1. Interest-Free Loans

The loans are offered without interest charges, ensuring beneficiaries can focus entirely on their business or housing improvements without financial stress.

2. Flexible Loan Amounts

Applicants can receive loans ranging from PKR 50,000 to PKR 500,000, depending on the nature of their business or home improvement needs.

3. Easy Repayment Plans

Borrowers are provided with flexible repayment schedules, usually spanning 1 to 3 years, to make the repayment process manageable.

4. Targeted Beneficiaries

The scheme prioritizes small business owners, low-income households, women entrepreneurs, and individuals from underprivileged areas.

Read More Information: CM Maryam Nawaz Approves 5,000 New Classrooms for Schools

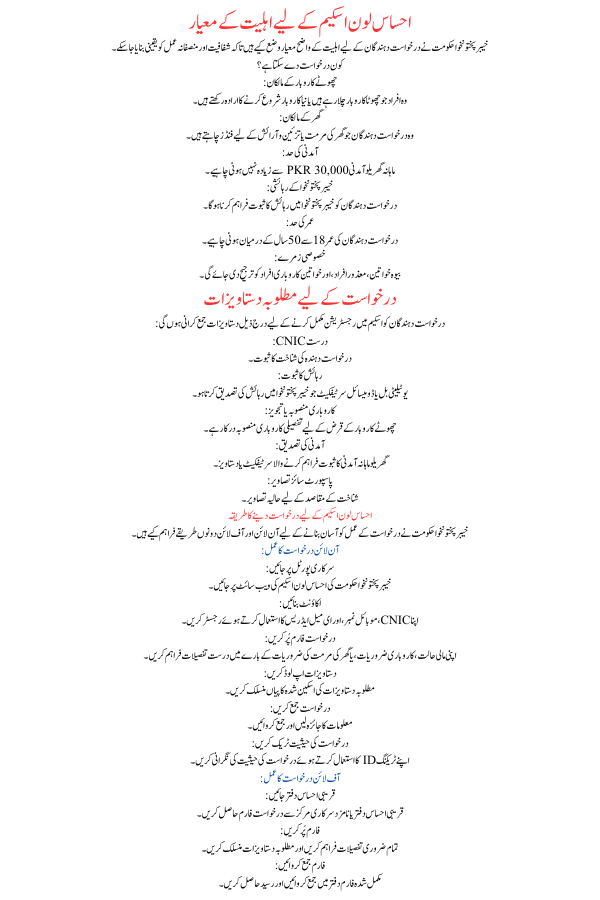

Eligibility Criteria for the Ehsaas Loan Scheme

To ensure fairness and transparency, the KP Government has outlined clear eligibility criteria for applicants:

Who Can Apply?

- Small Business Owners:

- Individuals running small businesses or planning to start one.

- Homeowners:

- Applicants seeking funds for home repairs or renovations.

- Income Limit:

- Monthly household income should not exceed PKR 30,000.

- Residents of Khyber Pakhtunkhwa:

- Applicants must provide proof of residency in KP.

- Age Limit:

- Applicants should be between 18 and 50 years old.

- Special Categories:

- Priority is given to widows, differently-abled individuals, and women entrepreneurs.

Required Documents for Application

Applicants are required to submit the following documents to complete their registration for the scheme:

- Valid CNIC: Proof of identity for the applicant.

- Proof of Residency: Utility bill or domicile certificate showing KP residency.

- Business Plan or Proposal: A detailed business plan is required for small business loans.

- Income Verification: A certificate or document proving the household’s monthly income.

- Passport-Sized Photographs: Recent photos for identification purposes.

Read More Information: Hunarmand Program For Youth Empowerment By CM Punjab

How to Apply for the Ehsaas Loan Scheme

The KP Government has simplified the application process by offering both online and offline methods:

Online Application Process

- Visit the Official Portal:

- Go to the KP Government Ehsaas Loan Scheme website.

- Create an Account:

- Register with your CNIC, mobile number, and email address.

- Fill Out the Application Form:

- Provide accurate details about your financial status, business needs, or home improvement requirements.

- Upload Documents:

- Attach scanned copies of the required documents.

- Submit the Application:

- Review the information and click submit.

- Track Your Application:

- Use your tracking ID to monitor the status of your application.

Offline Application Process

- Visit the Nearest Ehsaas Office:

- Collect an application form from the nearest Ehsaas or designated government office.

- Fill Out the Form:

- Provide all necessary details and attach the required documents.

- Submit the Form:

- Return the completed form to the office and collect a receipt.

Read More Information: Benazir Taleemi Wazifa For Poor Students

Loan Disbursement and Repayment

Disbursement Process

- Once approved, the loan amount will be directly transferred to the applicant’s bank account or provided as a cheque.

- For home improvement loans, funds may be disbursed in installments based on project progress.

Repayment Schedule

- Repayment periods range from 1 to 3 years, with monthly or quarterly installments.

- Borrowers will be reminded via SMS or email about upcoming payment deadlines.

Benefits of the Interest-Free Ehsaas Loan Scheme

This scheme offers multiple benefits to its participants:

- Economic Empowerment: Provides financial stability to small businesses and households.

- Women’s Inclusion: Encourages women to participate in economic activities by offering priority access.

- Improved Living Standards: Enables low-income families to renovate their homes and improve their quality of life.

- No Financial Burden: Interest-free loans ensure affordability and encourage timely repayment.

Important Dates

Applicants should take note of the following important dates:

- Application Start Date: January 15, 2024

- Application Deadline: Ongoing (apply as early as possible due to limited funds).

Conclusion

The KP Government’s Interest-Free Ehsaas Loan Scheme is a transformative initiative aimed at empowering small business owners and low-income families in the province. With its simple application process, flexible loan amounts, and interest-free terms, the scheme is a lifeline for those who need financial support to achieve their goals.

If you meet the eligibility criteria, don’t miss this opportunity to secure a better future for yourself and your family. Start your application today and take the first step toward economic independence.

Read More Information: Hunarmand Program For Youth Empowerment By CM Punjab

FAQs

1. Who can apply for the Ehsaas Loan Scheme?

Small business owners, homeowners, and low-income families residing in KP are eligible to apply.

2. How much loan can I get?

Applicants can receive loans ranging from PKR 50,000 to PKR 500,000.

3. Is there an interest rate on the loan?

No, the scheme offers interest-free loans.

4. How can I apply for the loan?

You can apply online through the official portal or offline by visiting the nearest Ehsaas office.

5. What is the repayment period?

The repayment period ranges from 1 to 3 years, depending on the loan amount.

By providing financial stability and opportunities, the Ehsaas Loan Scheme is a significant step toward the socio-economic development of Khyber Pakhtunkhwa.