Khud Mukhtar Loan

The Khud Mukhtar Program is a Pakistani government creativity aimed at allowing persons to start their own businesses by offering financial help through a 72,000 PKR loan. This program enables low-income persons, specially youth and women, to found supportable trades, reducing want and helping financial growth. This article provides a complete guide on the registration process, eligibility criteria, optional businesses, and more.

More Read:Benazir Taleemi Wazaif Program

The Benefits of the Khud Mukhtar Program

The Khud Mukhtar Program provides many benefits to qualified participants, enabling them to create a source of income freely. Here are the primary advantages:

- Financial Independence: By receiving financial support, persons can start their businesses, realizing financial self-support.

- Skill Development: Receivers receive training on running and growing their businesses, which helps in personal and qualified development.

- Reduced Unemployment: As people start businesses, they create jobs, paying to the local economy and reducing unemployment.

- Focused Support for Women and Youth: A important focus is on women and young individuals, allowing them and supporting gender parity in the cheap.

Khud Mukhtar Program Eligibility

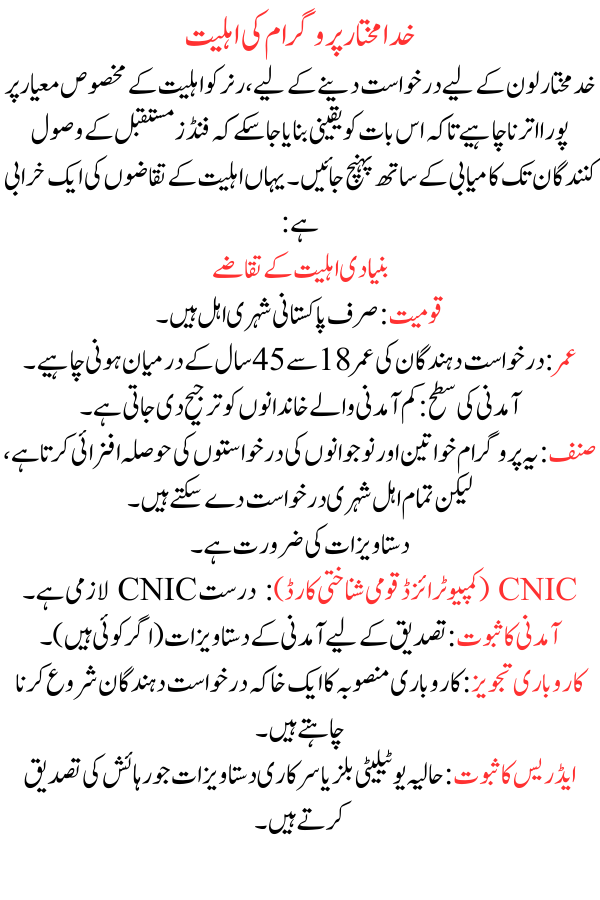

To apply for the Khud Mukhtar Loan, runners must meet specific eligibility criteria to ensure that the funds reach the future receivers successfully. Here’s a breakdown of the aptness requirements:

Basic Eligibility Requirements

- Nationality: Only Pakistani citizens are eligible.

- Age: Applicants must be between 18 and 45 years.

- Income Level: Preference is given to low-income families.

- Gender: The program encourages applications from women and youth, but all eligible citizens can apply.

More Read:Benazir Kafalat Program New Payments

Documentation Required

- CNIC (Computerized National Identity Card): Valid CNIC is mandatory.

- Proof of Income: Income documents (if any) for verification.

- Business Proposal: An outline of the business plan applicants wish to start.

- Address Proof: Recent utility bills or official documents confirming residence.

Program Exclusions

The Khud Mukhtar Loan is not available to:

- Persons with existing large-scale businesses.

- Employees of public or private sector organizations drawing a large income.

- Folks who have ducked on former government loans.

Suggested Businesses for the 72000 Khud Mukhtar Program Business Loan

The loan amount of PKR 72,000 may limit the scope of possible businesses, but several small businesses can thrive with this funding. Here are some suggested businesses:

Retail Shops

Small retail shops such as grocery stores, notebook shops, or mobile fittings outlets can be started with modest capital. Retail shops can produce daily income and have low upkeep costs.

Food Stalls or Small Cafés

Food stalls or curb cafés offering tea, snacks, or fast food can yield a high profit margin, as food businesses generally have steady demand.

More Read:Kisan Cards Transformed the Lives

Sewing or Tailoring Services

For women skilled in fitting, opening a sewing or embroidery business can be profitable, especially in local communities. The loan can cover the cost of sewing machines, fabric, and initial supplies.

Freelancing Business

Freelancing services, such as graphic design, content writing, or digital marketing, require minimal startup investment. A basic computer setup can allow individuals to work from home.

Poultry Farming

Poultry farming on a small scale can be a supportable business with a good return on investment, especially in rural areas where demand for fresh fowl products is high.

Applying for the Khud Mukhtar Loan Online: Step-by-Step Guide

Applying for the Khud Mukhtar Loan is straightforward, especially with online application options that streamline the process for applicants. Here’s a step-by-step guide:

Step 1: Visit the Official Website

- Go to the official Khud Mukhtar Program website (provide URL here if known).

- Navigate to the ‘Loan Application’ section.

Step 2: Complete the Registration Form

- Enter your personal details, including CNIC number, contact information, and housing address.

- Upload scanned copies of required documents (CNIC, proof of income, business plan, etc.).

Step 3: Submit the Business Proposal

- Write a brief outline of the business you plan to establish with the loan.

- Submit details like projected costs, target audience, and location.

More Read:Applying for and Using a Kisan Card

Step 4: Verification and Review

- Once you submit your application, the program’s team will review it.

- They may conduct a background check or ask for extra certification.

Step 5: Approval and Disbursement

- If your application is approved, you will receive a notice via email or SMS.

- The loan amount of PKR 72,000 will be disbursed directly to your bank account or through an approved payment method.

Offline Application Method

For folks unable to apply online, local offices of the Khud Mukhtar Program accept walk-in applications. Applicants can fill out a form in person and submit it with the required documents.

More Read:Kissan Cards Across Punjab

Conclusion

The Khud Mukhtar Program is a promising creativity for Pakistan’s low-income persons who aspire to be fiscally free by starting small businesses. With a loan amount of PKR 72,000, receivers can establish retail shops, food stalls, freelancing services, and more. This guide covers everything from the registration process, eligibility criteria, benefits, and optional business ideas to the online application steps. By following this information, applicants can apply for the loan with poise and embark on their journey toward financial freedom.