Punjab Rozgar Scheme

The Punjab Rozgar Scheme is a flagship initiative by the Government of Punjab to provide financial assistance to entrepreneurs, startups, and small businesses in the province. This scheme aims to promote self-employment, encourage economic growth, and reduce unemployment by offering low-interest loans to eligible individuals and businesses. Whether you are looking to expand your existing business or start a new venture, this program can provide the financial boost you need.

Below is a quick overview of the Punjab Rozgar Scheme for your convenience:

| Program Name | Punjab Rozgar Scheme |

| Start Date | January 2024 |

| End Date for Applications | December 31, 2024 |

| Loan Amount | PKR 100,000 to PKR 10,000,000 |

| Interest Rate | 4% to 5% |

| Application Method | Online |

Loan Scheme Key Features

The Punjab Rozgar Scheme stands out due to its flexible and inclusive features. Here are some of its key highlights:

- Low-Interest Rates:

Loans are offered at subsidized rates, ranging from 4% to 5%, making them affordable for small business owners. - High Loan Ceiling:

Entrepreneurs can avail loans up to PKR 10 million, depending on their business needs and project feasibility. - Focus on Economic Growth:

The scheme encourages innovation and growth by supporting a wide range of sectors, including manufacturing, services, and IT startups. - Support for Youth and Women:

Priority is given to youth-led initiatives and female entrepreneurs to promote inclusion and empowerment. - Flexible Repayment Tenure:

Loan repayment plans range from 2 to 5 years, allowing borrowers ample time to generate returns.

Read More: BOP Himmat Card New Registration Strated

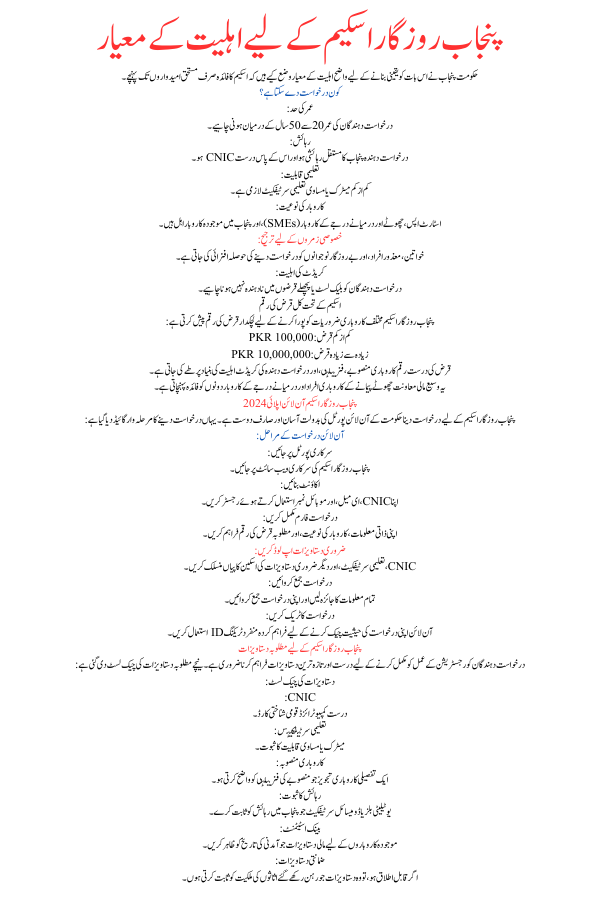

Punjab Rozgar Scheme Eligibility Criteria

To ensure that the scheme benefits deserving candidates, the Punjab Government has outlined clear eligibility requirements:

Who Can Apply?

- Age Limit:

- Applicants must be between 20 and 50 years old.

- Residency:

- Must be a permanent resident of Punjab with a valid CNIC.

- Educational Qualification:

- A minimum Matriculation certificate or equivalent is required for eligibility.

- Business Type:

- Startups, small and medium enterprises (SMEs), and existing businesses in Punjab are eligible.

- Special Categories:

- Women, persons with disabilities, and unemployed youth are strongly encouraged to apply.

- Creditworthiness:

- Applicants must not be blacklisted or have defaulted on previous loans.

Read More: Punjab Government Announced 35000 Free laptops for Matric

Total Loan Amount for the Scheme

The Punjab Rozgar Scheme offers flexible loan amounts to cater to different business needs:

- Minimum Loan: PKR 100,000

- Maximum Loan: PKR 10,000,000

- The exact loan amount is determined based on the business plan, feasibility, and applicant’s creditworthiness.

This wide range of financial support ensures that both small-scale entrepreneurs and medium-sized enterprises can benefit.

Read More:Chief Minister Honhaar Scholarship scheme in Punjab For Brilliant Students

Punjab Rozgar Scheme Online Apply 2024

Applying for the Punjab Rozgar Scheme is simple and user-friendly, thanks to the government’s online portal. Here’s a step-by-step guide to help you apply:

Steps for Online Application:

- Visit the Official Portal:

- Access the Punjab Rozgar Scheme’s official website.

- Create an Account:

- Register using your CNIC, email, and mobile number.

- Complete the Application Form:

- Provide details such as your personal information, business type, and loan amount required.

- Upload Required Documents:

- Attach scanned copies of your CNIC, educational certificates, and other necessary documents.

- Submit the Application:

- Review all the information and submit your application.

- Track Your Application:

- Use the unique tracking ID provided to check the status of your application online.

Read More: Eligibility Criteria for Punjabs Honhaar Scholarship Program

Required Documents for the Punjab Rozgar Scheme

Applicants must provide accurate and updated documents to complete the registration process. Below is a checklist of the required documents:

- CNIC: A valid computerized national identity card.

- Educational Certificates: Proof of matriculation or equivalent qualification.

- Business Plan: A detailed business proposal outlining the project’s feasibility.

- Proof of Residence: Utility bills or domicile certificate verifying Punjab residency.

- Bank Statement: Financial documents for existing businesses to demonstrate revenue history.

- Collateral Documents: If applicable, documents proving ownership of pledged assets.

What is the Loan Security?

To ensure responsible lending, the Punjab Rozgar Scheme Online Registration requires loan security or collateral in some cases.

Security Options Include:

- Personal Guarantee:

- A guarantor can assure the loan repayment.

- Collateral:

- Applicants may pledge movable or immovable assets, such as property or machinery.

- Partnership Agreements:

- For joint ventures, all partners must co-sign the loan agreement.

These measures help maintain the financial sustainability of the program while minimizing risks.

Read More: Benazir Hari Card to Support Farmers Through Bank

Punjab Rozgar Scheme Last Date 2024

The application window for the Punjab Rozgar Scheme closes on December 31, 2024.

Applicants are encouraged to complete their registrations well before the deadline to avoid last-minute delays.

Conclusion

The Punjab Rozgar Scheme Online Registration is a transformative initiative aimed at reducing unemployment and promoting entrepreneurship in Punjab. By offering low-interest loans, flexible repayment terms, and special support for marginalized groups, the program has already made a significant impact.

If you meet the eligibility criteria and have a viable business idea, this scheme provides the perfect opportunity to turn your dreams into reality. Start your application process today and take the first step toward financial independence.

FAQs

1. What is the Punjab Rozgar Scheme Online Registration ?

The Punjab Rozgar Scheme is a government loan initiative to support entrepreneurs, startups, and small businesses in Punjab.

2. How much loan does the Punjab Rozgar Scheme Online Registration provide?

The scheme offers loans ranging from PKR 100,000 to PKR 10,000,000, depending on the business needs.

3. Who is eligible for the Punjab Rozgar Scheme Online Registration ?

Permanent residents of Punjab, aged 20-50, with at least a matriculation qualification and a viable business plan, are eligible.

4. What is the processing fee for this Punjab Rozgar Scheme Online Registration ?

A nominal processing fee of PKR 2,000 to PKR 5,000 is applicable, depending on the loan amount.

5. What is the interest rate for the loan?

The interest rate ranges from 4% to 5%, making it affordable for small businesses.

By providing accessible financial resources, the Punjab Rozgar Scheme is paving the way for a brighter economic future in Pakistan.