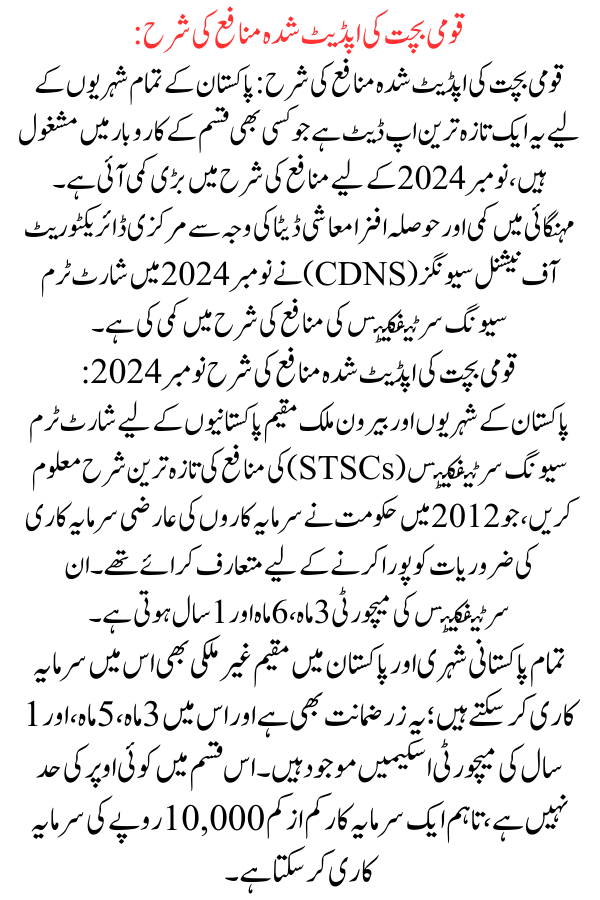

Qaumi Bachat Updated Profit Rate :

Qaumi Bachat Updated Profit Rate Here is the brand new Update for all the residents of Pakistan who are engaged in any range of industrial employer there is a great reduce in the income rate for November.

Due to a decline in inflation and encouraging monetary data, the Central Directorate of National Savings (CDNS) diminished the income rate for Short-Term Savings Certificates on November , 2024.

More Read:CM Higher Education Internship Program

| Category | Details |

| Program Name | Short-Term Saving Certificates (Qaumi Bachat) |

| Updated Profit Rate | 11.61% (Annualized) |

| Profit Payment Frequency | Quarterly |

| Investment Tenure | 3, 6, or 12 months |

| Minimum Investment | PKR 1,000 |

| Maximum Investment | No maximum limit, but subject to regulatory guidelines |

| Taxation | Profit is subject to tax as per applicable government rules |

| Profit Rate Change Date | Updated for November 2024 |

Quami Bachat Updated Profit Rate Nov 2024

Discover the up to date Rate of Quami Bachat For Short-Term saving certificates, to tackle investors’ non permanent funding needs, the authorities brought the Short Term Savings Certificates (STSCs) application in 2012. These certificates have maturities of three, six, and one year.

More Read:Ehsaas Kafalat Program

All Pakistani nationals and Pakistanis dwelling overseas can make investments in it; it is pledgeable and has 3-month, 5-month, and 1-year maturity schemes. In this category, there is no top limit, however an investor might also credit a minimal of Rs 10,000.

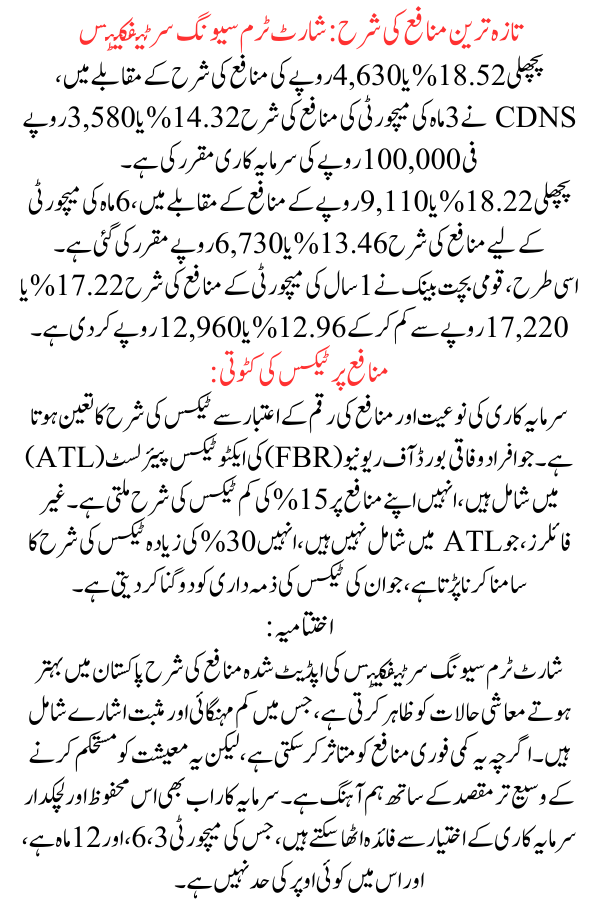

Latest Profit Rate: Short-Term Saving Certificates

- In distinction to the preceding 18.52% or Rs4,630 income rate, the CDNS has set the three-month maturity income charge at 14.32 percent, or Rs3,580, on investments of every Rs100,000.

- In distinction to the preceding 18.22% or Rs 9,110, the earnings price for the six-month maturity class has been set at 13.46% or Rs 6,730.

- Likewise, Qaumi Bachat Bank has decreased its one-year maturity earnings price from 17.22%, or Rs17,220, to 12.96%, or Rs12,960.

Tax Deduction For Profit Rate

The taxpayer’s feature as a filer or non-filer determines the charge of withholding tax assessed on earnings from investments made beneath CDNS schemes, such as Short-Term Savings Certificates (STSCs).

Regardless of the funding date or revenue amount, filers who are listed on the Federal Board of Revenue’s (FBR) Active Taxpayer List (ATL) are eligible for a diminished tax charge of 15% on their yield or profit. Non-filers, on the distinctive hand, who do now now not exhibit up on the ATL, are problem to a a lengthy way increased tax charge of 30%, which in fact doubles their tax responsibility.

More Read:Registration of Punjab Green Tractor Scheme

Conclusion

The up to date profits expenses for Short-Term Savings Certificates replicate the improving monetary stipulations in Pakistan, marked via way of minimize inflation and high-quality indicators. While the lowered costs can additionally have an have an impact on on instant returns, they align with the broader cause of stabilizing the economy. Investors can however benefit from this tightly closed and flexible funding option, with maturities of 3, 6, and 12 months, and no greater deposit rating limit.

More Read:Government’s Installment Plan Increases Hajj