interest-free housing loan

The Khyber Pakhtunkhwa Interest-Free Housing Loan Program is a commendable initiative aimed at helping low-income families achieve their dream of owning a home. This program is particularly focused on providing financial assistance without any interest, enabling underprivileged citizens to build or renovate their homes without the burden of high costs. The scheme aligns with the government’s vision to provide affordable housing solutions and uplift the socioeconomic conditions of the people in the province.

Quick Information Table

| Name of the Program | Khyber Pakhtunkhwa Interest-Free Housing Loan |

| Start Date | 2023 |

| End Date | Ongoing |

| Amount of Assistance | Up to PKR 2.5 million |

| Method of Application | Both Online and Offline |

Objectives of the Program

The primary goal of this initiative is to ensure that the housing needs of low-income families are met without adding financial stress. The program also aims to:

- Reduce the housing deficit in Khyber Pakhtunkhwa.

- Empower economically weaker sections by providing affordable housing loans.

- Promote economic activity in the construction and housing sectors.

Read Also: Benazir Kafaalat Third Phase Payment

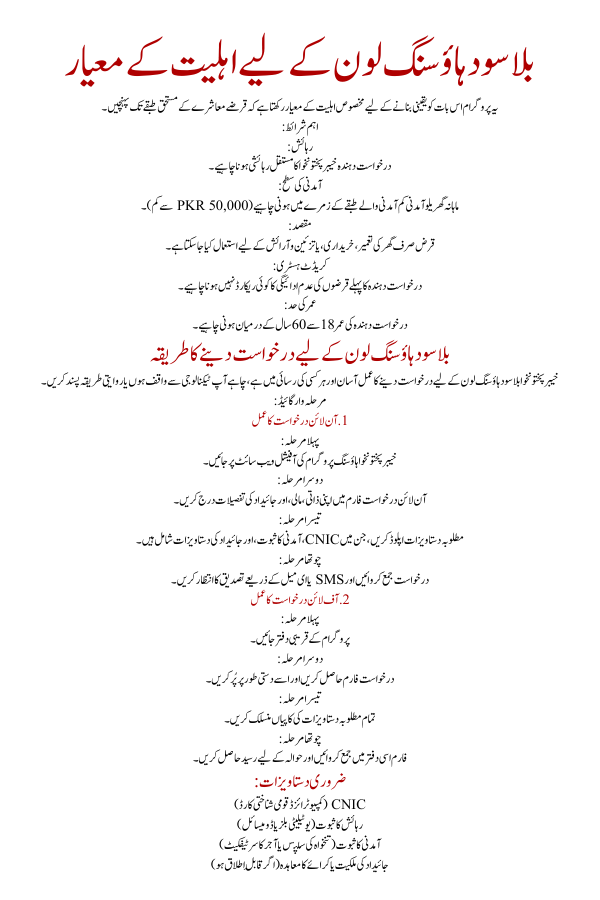

Eligibility Criteria for interest-free housing loan

The program has specific eligibility requirements to ensure that the loans reach the deserving segments of society.

Key Requirements:

- Residency:

- Applicants must be permanent residents of Khyber Pakhtunkhwa.

- Income Level:

- Monthly household income should fall within the low-income bracket (less than PKR 50,000).

- Purpose:

- Loans must be used strictly for building, purchasing, or renovating a house.

- Credit History:

- Applicants should not have any prior loan defaults.

- Age Limit:

- Applicants must be between 18 to 60 years old.

How to Apply for interest-free housing loan

Applying for the Khyber Pakhtunkhwa Interest-Free Housing Loan is a straightforward process. The program is designed to be accessible to everyone, whether they are tech-savvy or not.

Step-by-Step Guide:

1. Online Application Process

- Step 1: Visit the official website of the Khyber Pakhtunkhwa Housing Program.

- Step 2: Fill out the online application form with personal, financial, and property details.

- Step 3: Upload the required documents, including CNIC, proof of income, and property documents.

- Step 4: Submit the application and wait for confirmation via SMS or email.

2. Offline Application Process

- Step 1: Visit the nearest designated office of the program.

- Step 2: Collect the application form and fill it out manually.

- Step 3: Attach copies of all required documents.

- Step 4: Submit the form at the same office and obtain a receipt for reference.

Required Documents:

- CNIC (Computerized National Identity Card)

- Proof of residence (utility bills or domicile)

- Proof of income (salary slips or employer’s certificate)

- Property ownership or rental agreement (if applicable)

Read Also:Balochistan Empowers Women with Pink Scooty Scheme

Loan Features and Terms

The housing loan program is structured to provide maximum benefit to eligible citizens with minimal repayment burden.

Loan Amount:

- Applicants can receive loans of up to PKR 2.5 million, depending on the project and financial need.

Repayment Terms:

- Repayment periods range from 5 to 20 years, with flexible installment options.

Interest-Free Policy:

- The program adheres to a strict no-interest policy, ensuring affordable housing for all.

Additional Benefits:

- No hidden charges or processing fees.

- Priority is given to widows, orphans, and disabled individuals.

Read Also: Over 26 Lakh Women Acquiring Support

Benefits of the Program

The Khyber Pakhtunkhwa Interest-Free Housing Loan offers several advantages to applicants, including:

- Financial Relief:

- Eliminates the burden of high-interest loans.

- Improved Living Standards:

- Enables families to construct safe and comfortable homes.

- Economic Growth:

- Boosts local employment in the construction sector.

- Community Development:

- Strengthens communities by providing stable housing.

Read Also:Karobar Card Loan Scheme

Challenges and Solutions

While the program has been successful in reaching many beneficiaries, some challenges remain:

- Lack of Awareness:

- Many eligible citizens are unaware of the program.

- Solution: Increased awareness campaigns through TV, radio, and community events.

- Document Submission Issues:

- Incomplete or incorrect documentation leads to delays.

- Solution: Clear guidelines and application support centers.

- Processing Delays:

- High application volumes can slow down approvals.

- Solution: Strengthening administrative capacity and introducing automated systems.

FAQs

1. Can I apply for this loan if I am already repaying another loan?

Yes, but only if you meet the creditworthiness criteria and your existing loan does not exceed your financial capacity.

2. How long does it take for the loan to be approved?

On average, the approval process takes 2 to 4 weeks, depending on the completeness of your application.

3. Is collateral required for this loan?

In most cases, the property being financed serves as collateral.

4. Can widows or orphans apply for this program?

Yes, widows and orphans are given priority under the program’s special provisions.

Conclusion

The Khyber Pakhtunkhwa Interest-Free Housing Loan is a groundbreaking initiative, ensuring that every citizen has access to safe and affordable housing. By providing financial relief without interest, this program is empowering families to achieve long-term stability and improved living conditions.

Read Also:1 Crore Youth Business Loan Scheme

If you or someone you know is eligible for this program, don’t hesitate to apply. This is an opportunity to turn your dream of owning a home into reality without the burden of interest. Visit the official website or your nearest program office to start your application today!