Karobar Card Loan Scheme

The Karobar Card Loan Scheme is an initiative designed to empower small businesses in Pakistan. With a focus on financial inclusion and entrepreneurship, this scheme, alongside the Chief Minister Aasan Karobar Financing Scheme, provides accessible loans to small business owners. The program aims to boost economic activity, create job opportunities, and strengthen the small and medium enterprise (SME) sector. This article offers an in-depth look at these schemes, their objectives, application process, and anticipated impact.

Quick Information Table

| Name of the Program | Karobar Card Loan Scheme |

| Start Date | Varies (Depends on region) |

| End Date | Ongoing |

| Amount of Assistance | Up to PKR 2 million |

| Method of Application | Online and Offline |

Chief Minister Aasan Karobar Financing Scheme

The Chief Minister Aasan Karobar Financing Scheme is a key component of the Karobar Card Loan initiative. This scheme specifically targets aspiring entrepreneurs and existing small business owners by offering interest-free or low-interest loans. It is a provincial government effort to tackle unemployment and promote sustainable economic growth.

Key Features:

- Interest-Free Loans: Aimed at providing relief to the underprivileged.

- Loan Amount: Ranges from PKR 50,000 to PKR 2 million.

- Repayment Flexibility: Easy installment plans to reduce financial burden.

- Digital Processing: Applications can be submitted through user-friendly online portals.

Read Also:Balochistan Empowers Women with Pink Scooty Scheme

Objectives of the Karobar Card Scheme

The primary goals of the Karobar Card Scheme include:

Supporting Small Businesses

- Provide financial backing to small and medium-sized enterprises (SMEs).

- Encourage new entrepreneurs to enter the market.

Reducing Poverty and Unemployment

- Promote job creation through business growth.

- Enable individuals to become self-reliant and financially independent.

Enhancing Financial Inclusion

- Bring unbanked individuals into the formal banking sector.

- Encourage digital and cashless transactions.

Strengthening the Economy

- Contribute to GDP growth by fostering small-scale industries.

- Develop local markets and supply chains.

Read Also:Benazir Kafaalat Third Phase Payment

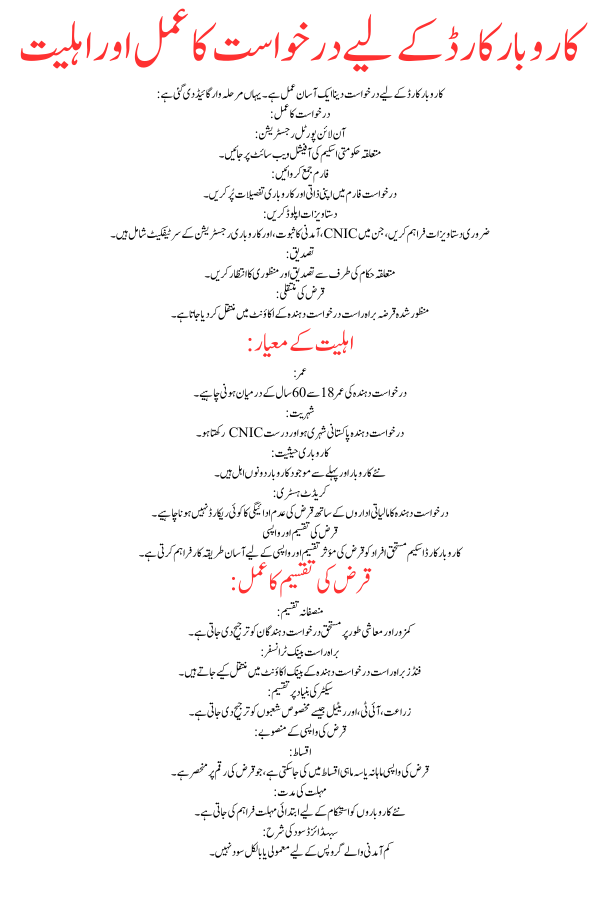

Karobar Card Application Process and Eligibility

Applying for the Karobar Card is a straightforward process. Here’s a step-by-step guide:

Application Process:

- Online Portal Registration: Visit the official website of the respective government scheme.

- Form Submission: Fill out the application form with personal and business details.

- Document Upload: Provide supporting documents, including CNIC, proof of income, and business registration certificates.

- Verification: Await verification and approval by the concerned authorities.

- Loan Disbursement: Approved loans are directly credited to the applicant’s account.

Eligibility Criteria:

- Age: Applicants must be between 18 to 60 years old.

- Residency: Must be a Pakistani citizen with a valid CNIC.

- Business Status: Both startups and existing businesses are eligible.

- Creditworthiness: Applicants should not have any default history with financial institutions.

Read Also:Distribution of Rs. 10500 for Khyber Pakhtunkhwa

Loan Distribution and Repayment

The Karobar Card Scheme ensures efficient loan distribution and repayment mechanisms to facilitate beneficiaries.

Distribution Process:

- Equitable Allocation: Priority is given to underprivileged and economically vulnerable applicants.

- Direct Bank Transfer: Funds are directly transferred to the applicant’s bank account.

- Sector-Based Allocation: Specific sectors like agriculture, IT, and retail are prioritized.

Repayment Plans:

- Installments: Monthly or quarterly installments, depending on the loan size.

- Grace Period: Initial grace period for startups to stabilize operations.

- Subsidized Interest Rates: Minimal or no interest rates for low-income groups.

Read Also:1 Crore Youth Business Loan Scheme

Anticipated Impact of the Schemes

The Karobar Card Loan Scheme and Chief Minister Aasan Karobar Financing Scheme are expected to bring transformative changes to Pakistan’s economy.

Economic Growth

- Boost in local industries and entrepreneurship.

- Increased contribution of SMEs to GDP.

Social Impact

- Reduction in unemployment rates.

- Enhanced standard of living for families benefiting from new business ventures.

Financial Sector Development

- Integration of unbanked individuals into formal financial systems.

- Increased use of digital payment systems.

Read Also:Khyber Pakhtunkhwa’s interest-free housing loan

Conclusion

The Karobar Card Loan Scheme is a significant step toward fostering entrepreneurship and supporting small businesses in Pakistan. With user-friendly application processes, flexible repayment options, and targeted financial assistance, these schemes hold the potential to drive economic growth and alleviate poverty. By making resources accessible to budding entrepreneurs, the government aims to build a resilient and prosperous nation.

For aspiring business owners, this initiative offers a golden opportunity to achieve financial independence and contribute positively to the economy. Start your journey today by applying for the Karobar Card Loan Scheme and pave the way for a brighter future.