BISP Savings Scheme: A New Opportunity for Financial Growth

The Benazir Income Support Program (BISP) has introduced an innovative initiative called the BISP Savings Scheme. This program is designed to provide financial growth opportunities for individuals already benefiting from BISP and those working in informal sectors like daily wage jobs.

If you want to know more about eligibility, registration steps, and key benefits, this article has all the details you need. For housing-related benefits, you can explore the Canal Bank Housing Scheme for additional support.

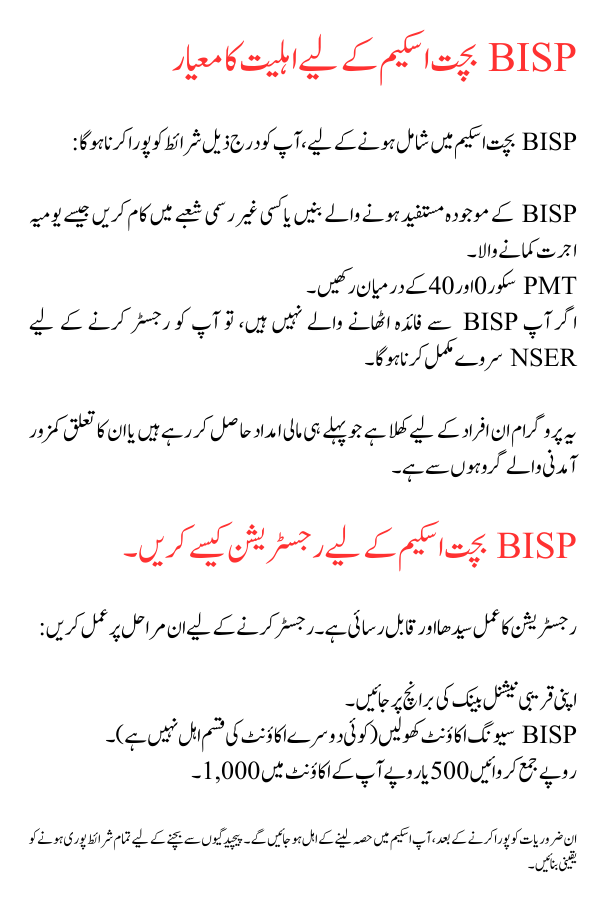

Eligibility Criteria for the BISP Savings Scheme

To join the BISP Savings Scheme, you must meet the following conditions:

- Be a current BISP beneficiary or work in an informal sector such as a daily wage earner.

- Have a PMT score between 0 and 40.

- If you are not a BISP beneficiary, you must complete the NSER survey to register.

This program is open to individuals who are already receiving financial aid or belong to vulnerable income groups.

For those interested in other youth-focused initiatives, the Maryam Nawaz Laptop Distribution Program could also be of great value.

How to Register for the BISP Savings Scheme

The registration process is straightforward and accessible. Follow these steps to register:

- Visit your nearest National Bank branch.

- Open a BISP savings account (no other account type qualifies).

- Deposit Rs. 500 or Rs. 1,000 into your account.

After meeting these requirements, you will be eligible to participate in the scheme. Ensure all conditions are met to avoid complications.

Looking for further financial support? Learn about the Punjab Bike Scheme and its benefits for workers.

How the BISP Savings Scheme Works

Participants in the scheme can earn additional profits by saving regularly. Here’s how it works:

- Deposit between Rs. 500 and Rs. 1,000 per month.

- BISP adds a 40% profit on your savings.

- The scheme duration is two years.

At the end of two years, you can withdraw your full savings, including the profit. Alternatively, you can withdraw the profit during the scheme’s term if needed.

However, once you leave the scheme, you cannot rejoin.

For housing options, consider the 3 Marla Plot Under Apni Chhat Apna Ghar Scheme, a great way to secure affordable property.

Key Information About BISP Savings Scheme

- This program ensures financial security and promotes a culture of saving.

- Withdraw profits whenever required during the two-year period.

- Leaving the scheme early means forfeiting re-entry.

The scheme’s profitability and flexibility make it an excellent choice for those seeking long-term savings solutions.

Additionally, check out the Pink Scooties Initiative for Working Women to explore other government-led empowerment programs.

FAQs

Q1: What is the BISP Savings Scheme?

The BISP Savings Scheme is a financial program offering a 40% profit on monthly savings for BISP beneficiaries and informal workers.

Q2: Who can join the scheme?

Eligible participants include BISP beneficiaries and informal workers with a PMT score between 0 and 40. Non-BISP participants must complete the NSER survey.

Q3: How much can I save through this scheme?

Participants can deposit Rs. 500 to Rs. 1,000 per month and earn a 40% profit over two years.

Q4: Can I withdraw my savings before two years?

You can withdraw the profit anytime during the scheme, but leaving early forfeits your ability to rejoin.

Q5: How do I register for the scheme?

Visit a National Bank branch, open a BISP savings account, and deposit the required amount to qualify.

Also Read: Chief Minister Flood Relief Programme

Read more: https://8171kasincard.com