Ehsaas Apna Ghar Scheme 15 Lakh Loan

The Ehsaas Apna Ghar Scheme is a transformative initiative launched by the Government of Pakistan to provide affordable housing solutions to low-income families. Designed to tackle the country’s housing crisis, this program offers financial assistance and easy repayment plans, enabling people to construct or own homes without undue financial strain. With a focus on transparency and inclusivity, the scheme aligns with broader government efforts to uplift vulnerable communities and promote sustainable development.

Read More Info: Minority Card Online Registration

Quick Information Table

| Program Name | Ehsaas Apna Ghar Scheme |

| Start Date | January 2024 |

| End Date | Ongoing |

| Loan Amount | PKR 500,000 to PKR 3,000,000 |

| Eligibility | Low-income families, women, and disabled individuals |

| Repayment Period | Up to 15 years |

| Application Method | Currently offline, online registration coming soon |

Loan Details Under the Ehsaas Apna Ghar Scheme

The Ehsaas Apna Ghar Scheme provides financial support in the form of low-interest or interest-free loans to eligible applicants. This assistance ensures that people from underprivileged backgrounds can achieve the dream of owning a home.

1. Financial Assistance

The scheme offers loans ranging from PKR 500,000 to PKR 3,000,000, depending on the applicant’s financial needs and the project size. The funds can be used for:

- Building a new house.

- Renovating or expanding an existing home.

This support is particularly aimed at rural and low-income urban areas where housing is a critical issue.

2. Easy Repayment Plan

The repayment plans are designed to be flexible, with options for:

- Repayment Tenure: Up to 15 years.

- Low Monthly Installments: Tailored to the applicant’s income.

- Interest-Free Loans: For the most vulnerable groups, such as widows and disabled individuals.

3. Revolving Fund System

A revolving fund ensures sustainability, as repayments are reinvested to provide loans to other beneficiaries. This system creates a continuous cycle of support, maximizing the program’s impact.

Read More Info: IMF Approves Increased Stipend for Pakistan’s BISP Program

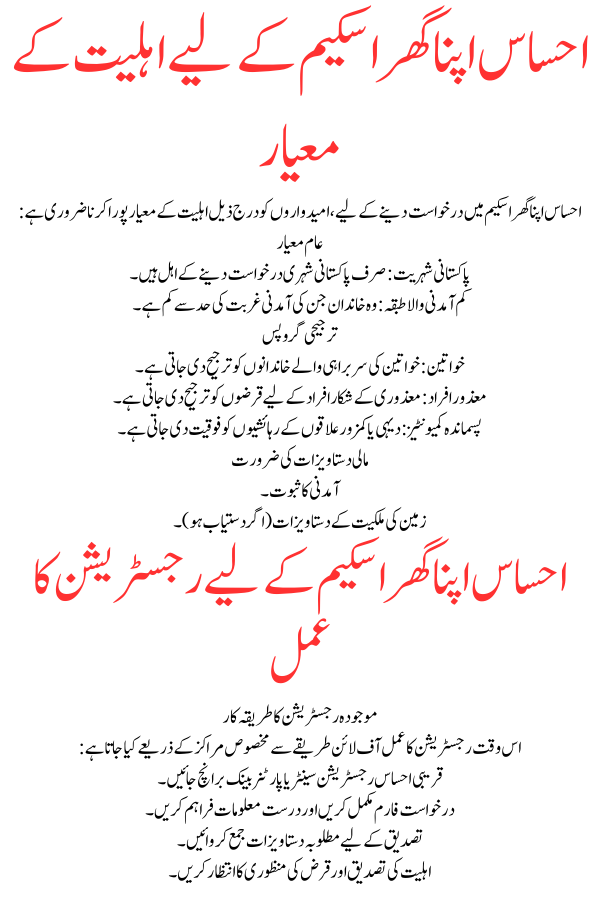

Eligibility Criteria for Ehsaas Apna Ghar Scheme

To qualify for the scheme, applicants must meet specific eligibility requirements:

General Criteria

- Pakistani Citizenship: Only citizens of Pakistan are eligible.

- Low-Income Group: Families earning below the poverty threshold.

Priority Groups

- Women: Female-headed households are given preference.

- Disabled Individuals: Loans are prioritized for those with disabilities.

- Marginalized Communities: Residents of rural or underserved areas.

Required Financial Documentation

- Proof of income.

- Land ownership documents (if applicable).

Registration Process for Ehsaas Apna Ghar Scheme

Current Registration Procedure

At present, the application process is conducted offline through designated centers:

- Visit the nearest Ehsaas Registration Center or partner bank branch.

- Fill out the application form with accurate details.

- Submit the required documents for verification.

- Await confirmation of eligibility and loan approval.

Online Registration (Coming Soon)

To enhance accessibility, the government is developing an online portal for Ehsaas Apna Ghar Scheme registration. Once launched, applicants will be able to:

- Register from the comfort of their homes.

- Upload necessary documents digitally.

- Track their application status online.

This move aims to streamline the process and expand the program’s reach.

Read More Info:Ehsaas Tracking Pass Status Online

Required Documents

Applicants must provide the following documents to complete their registration:

- CNIC: Proof of identity.

- Proof of Income: Salary slips, tax returns, or other relevant documents.

- Land Ownership or Rental Agreement: Proof of property for construction or renovation.

- Utility Bills: Recent bills for address verification.

- Affidavit: Declaring the applicant’s financial need and intent to use the funds for housing purposes.

Ensuring all documents are accurate and complete will expedite the application process.

Implementation Partners and Transparency

Key Partners

The Ehsaas Apna Ghar Scheme operates in collaboration with:

- Partner Banks: Facilitating loan disbursement and repayment.

- NGOs: Assisting in outreach and application support.

- Provincial Governments: Overseeing implementation at the local level.

Commitment to Transparency

The government has implemented strict monitoring measures to ensure transparency, including:

- Digital Tracking: For fund allocation and repayment.

- Audits: Regular third-party audits to prevent misuse.

- Public Reports: Making program updates accessible to the public.

Read More Info: Sindh Govt Announces Security Cards To Senior Citizens

Broader Government Initiatives

The Ehsaas Apna Ghar Scheme is part of a larger effort by the government to address Pakistan’s housing crisis. Other related initiatives include:

- Naya Pakistan Housing Program: Offering affordable housing units across the country.

- Ehsaas Kafalat: Providing financial aid to women and disadvantaged groups.

- Kamyab Pakistan Program: Empowering citizens through micro-loans and skill development.

These programs collectively aim to improve living standards and reduce poverty nationwide.

Read More Info: IUB Ehsaas Scholarship 2024

Conclusion

The Ehsaas Apna Ghar Scheme is a landmark initiative that addresses the critical need for affordable housing in Pakistan. By offering financial assistance, flexible repayment plans, and prioritizing marginalized groups, the program is paving the way for a more equitable and prosperous society.

With its focus on transparency and inclusivity, the scheme not only provides homes but also restores dignity and hope to those who need it most. As the program continues to expand, its impact on the lives of millions of Pakistanis will undoubtedly be transformative.

FAQs

1. What is the Ehsaas Apna Ghar Scheme 15 Lakh Loan?

The scheme provides financial assistance and interest-free loans to low-income families for building or renovating homes.

2. How much loan can I get under this Ehsaas Apna Ghar Scheme 15 Lakh Loan?

Loans range from PKR 500,000 to PKR 3,000,000, depending on the applicant’s financial needs.

3. Who is eligible for the Ehsaas Apna Ghar Scheme 15 Lakh Loan?

Pakistani citizens from low-income families, with priority given to women, disabled individuals, and marginalized communities.

4. How can I apply for the Ehsaas Apna Ghar Scheme 15 Lakh Loan?

Currently, you can apply offline through Ehsaas Registration Centers. Online registration will be available soon.

5. What documents are required for Ehsaas Apna Ghar Scheme 15 Lakh Loan registration?

Applicants need their CNIC, proof of income, property documents, utility bills, and an affidavit.

This program is a step forward in ensuring that every Pakistani has access to a safe and secure home, contributing to the nation’s social and economic growth.