Life Insurance Scheme

The Khyber Pakhtunkhwa (K-P) government has announced a comprehensive “Life Insurance Scheme for All” scheme to provide financial security for families across the province. This initiative is part of the province’s ongoing commitment to welfare and social security. By confirming financial assistance for households after the demise of a family head, the program aims to alleviate the economic burden on the affected families.

More Read:BISP Kafalat 13500 Payment Increase

Quick Details

| Program Name | Life Insurance for All Citizens |

| Start Date | Announced in October 2024, implementation ongoing |

| End Date | Ongoing |

| Compensation Amount | Up to PKR 1 million (under 60), PKR 500,000 (over 60) |

| Eligibility | All permanent residents of K-P |

| Application Method | Automatic (linked to CNIC records) |

| Documents Required | CNIC and proof of residency |

Objectives of the Scheme

The life insurance Scheme initiative is aimed at:

- Financial Protection: Offering direct relief to families after the death of their breadwinners.

- Inclusive Welfare: Covering all citizens, regardless of their income level or employment status.

- Ease of Access: Using existing CNIC records for automatic enrollment to minimalize barriers.

- Social Security: Building a safety net for families to help them manage vital expenses during crises.

More Read:Punjab CM Distributes Free Carts at Model Bazaar

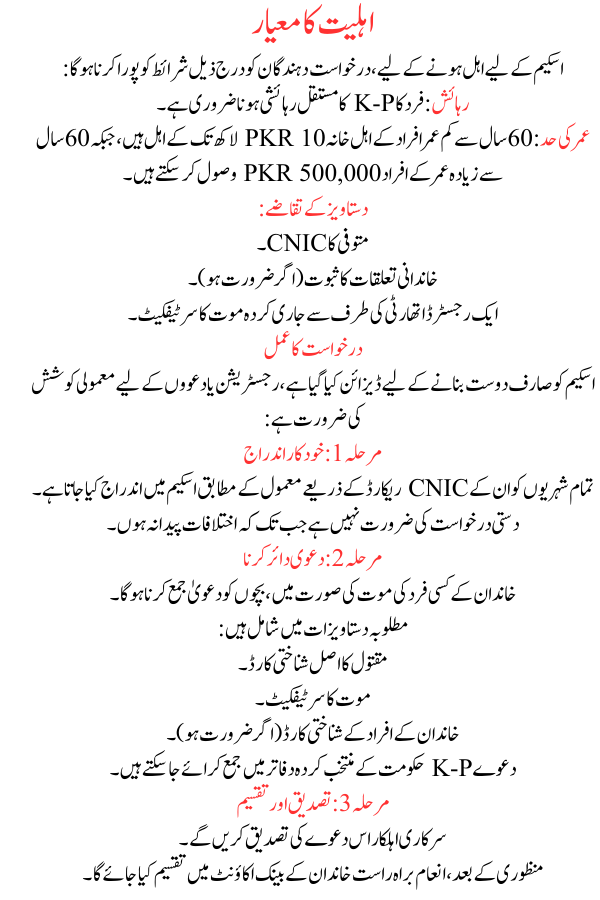

Eligibility Criteria

To qualify for the Life Insurance Scheme, applicants must meet the following conditions:

- Residency: The individual must be a permanent resident of K-P.

- Age Limit: Families of persons under 60 years are eligible for up to PKR 1 million, while those over 60 years can receive PKR 500,000.

- Document Requirements:

- CNIC of the deceased.

- Proof of family relationship (if required).

- Death certificate issued by a registered authority.

Application Process

The scheme is designed to be user-friendly, with marginal effort required for registration or claims:

Step 1: Automatic Enrollment

- All citizens are routinely enrolled in the scheme through their CNIC records.

- No need for manual application unless differences arise.

Step 2: Filing a Claim

- In case of the death of a family member, the children must submit a claim.

- Required documents include:

- Original CNIC of the deceased.

- Death certificate.

- CNICs of family members (if required).

- Claims can be submitted to the chosen offices of the K-P government.

More Read:BISP Bachat Scheme Online Apply

Step 3: Verification and Disbursement

- Government officials will verify the claim.

- Once approved, the reward will be disbursed directly to the family’s bank account.

Key Features of the Scheme

Comprehensive Coverage

The scheme covers all citizens of the area without taste, ensuring reasonable access to benefits.

Islamic Insurance Option

A significant feature of the program is the outline of Islamic Takaful insurance, providing Sharia-compliant cover for those who prefer it.

No Financial Contribution from Citizens

The program is fully funded by the local government, making it nearby to all populaces without extra costs.

More Read:ADB Loan for Climate Resilience Scheme

FAQs

Who is eligible for this life insurance?

All permanent residents of K-P are eligible, with no omissions based on income or service status.

Is there an age limit for claiming the insurance?

Yes, persons under 60 are eligible for up to PKR 1 million, while those over 60 can claim up to PKR 500,000.

How can I apply for this scheme?

You do not need to apply. Enrollment is involuntary, linked to your CNIC. Claims can be submitted upon the death of a family member.

More Read:Balochistan Empowers Women with Pink Scooty Scheme

What documents are required for a claim?

Essential documents include the CNIC of the deceased, a death certificate, and family connection proof (if requested).

Is this scheme limited to specific income groups?

No, it is open to all citizens, regardless of income level.

Conclusion

The “Life Insurance Scheme for All” scheme introduced by the K-P government is a important step towards ensuring social security and financial stability for its residents. By providing recompense for the loss of a family head, it supports families during their most interesting times.