Apni Chhat Apna Ghar Programme Loan Cheques

In a important step towards speaking the housing crisis in Pakistan, Chief Minister Maryam Nawaz has dispersed loan cheques to registered recipients under the Apni Chhat Apna Ghar Programme Loan Cheques. This creativity aims to provide interest-free loans to low and middle-income families, helping them build or ordering their own homes. The program is designed to empower families by if financial help and making the dream of owning a home a reality.

This complete article covers all you need to know about the Apni Chhat Apna Ghar Programme Loan Cheques, counting loan amounts, eligibility criteria, application process, and more.

More Read:Register for 8171 BISP Card Online

Quick Information Table

| Program Name | Apni Chhat Apna Ghar Programme |

| Announced By | CM Maryam Nawaz |

| Start Date | 2024 |

| End Date | Ongoing |

| Loan Amount | PKR 500,000 to PKR 2,500,000 |

| Interest Rate | 0% (Interest-Free) |

| Method of Application | Online & Offline |

| Target Audience | Low and Middle-Income Families |

| Loan Repayment Period | 5 to 10 Years |

| Helpline | 8171 |

Introduction to Apni Chhat Apna Ghar Programme

The Apni Chhat Apna Ghar Programme Loan Cheques was launched to support folks and families who struggle to afford their own homes due to financial restraints. This creativity, lead by CM Maryam Nawaz, aims to uplift low and middle-income groups by offering interest-free loans for building or buying a house.

This program ensures that families can enjoy the security and firmness that come with owning a home, giving to improved living conditions and socio-economic growth in the country.

Objectives of the Programme

The Apni Chhat Apna Ghar Programme is planned to achieve several key goals:

- Affordable Housing: Provide nearby housing solutions for low and middle-income families.

- Financial Support: Offer interest-free loans to ease the monetary burden of homeownership.

- Social Stability: Improve living settings and promote family well-being.

- Economic Growth: Boost the building sector and generate employment chances.

- Women’s Empowerment: Encourage female tenure and joint property registering for families.

More Read:Ehsaas Nojawan Program Online Registration

Loan Amount and Financial Assistance

The program offers interest-free loans ranging from PKR 500,000 to PKR 2,500,000 based on the receiver’s needs and financial condition. These funds can be used for:

- Building a new house

- Purchasing an existing home

- Renovating an old property

Loan Repayment Terms

- Repayment Duration: 5 to 10 years

- Installment Method: Monthly or quarterly installments

- Interest Rate: 0% (Interest-Free)

These flexible repayment terms ensure that receivers can repay the loan without facing financial hardship.

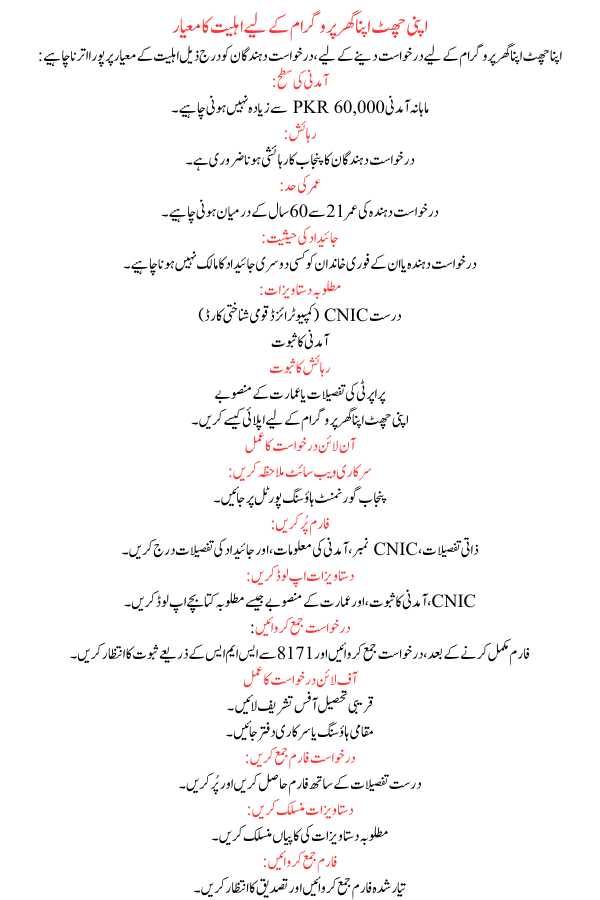

Eligibility Criteria for Apni Chhat Apna Ghar Programme

To apply for the Apni Chhat Apna Ghar Programme, applicants must meet the following eligibility criteria:

- Income Level:

- Monthly income should not exceed PKR 60,000.

- Residency:

- Applicants must be residents of Punjab.

- Age Limit:

- The applicant must be between 21 and 60 years old.

- Property Status:

- The applicant or their instant family should not own any other property.

- Documents Required:

- Valid CNIC (Computerized National Identity Card)

- Proof of income

- Proof of residence

- Property details or building plans

More Read:Benazir Taleemi December Installment 4500

How to Apply for the Apni Chhat Apna Ghar Programme

Online Application Process

- Visit the Official Website:

- Go to the Punjab Government Housing Portal.

- Fill Out the Form:

- Enter personal details, CNIC number, income information, and property details.

- Upload Documents:

- Upload required leaflets like CNIC, income proof, and building plans.

- Submit Application:

- After finishing the form, submit the application and await proof via SMS from 8171.

Offline Application Process

- Visit the Nearest Tehsil Office:

- Go to the local housing or government office.

- Collect the Application Form:

- Obtain and fill out the form with accurate details.

- Attach Documents:

- Attach copies of required documents.

- Submit Form:

- Submit the finished form and wait for verification.

More Read:Punjab Government Announce Karobar Card Loan Scheme

Benefits of the Apni Chhat Apna Ghar Programme

Home Ownership

This program makes it calmer for low and middle-income families to own a home, refining their quality of life.

Interest-Free Loans

Unlike traditional loans, receivers do not have to pay any interest, making payment wieldy and stress-free.

Employment Opportunities

The building and housing sectors will knowledge growth, creating jobs for laborers, engineers, and workers.

Social Security

Owning a home provides families with a sense of security, constancy, and pride, leading to improved social well-being.

When Will the Loan Distribution Start?

Loan cheques have already started being spread to registered heirs. The program is currently ongoing, and more families will receive fiscal help in the coming months. The government aims to ensure that all eligible applicants receive timely support.

More Read:Khyber Pakhtunkhwa’s interest-free housing loan

Economic Impact of the Programme

The Apni Chhat Apna Ghar Programme is likely to:

- Boost the Housing Sector: Increased demand for building resources and labor.

- Support Local Businesses: Growth in related trades like furniture, electrical, and hygiene services.

- Reduce Housing Shortages: More families will have access to safe and cheap housing.

Final Words

The Apni Chhat Apna Ghar Programme Loan Cheques is a fanciful creativity by CM Maryam Nawaz to support low and middle-income families in grasping homeownership. By offering interest-free loans and easy repayment terms, the program aims to transform the lives of limitless families in Punjab. If you or someone you know meets the eligibility criteria, apply now to benefit from this chance and take a step towards securing your own home.

FAQs

What is the maximum loan amount under the Apni Chhat Apna Ghar Programme?

The all-out loan amount is PKR 2,500,000.

Is the loan interest-free?

Yes, the loans providing under this program are completely interest-free.

More Read:Balochistan Empowers Women with Pink Scooty Scheme

Who is eligible for this program?

Low and middle-income families with a monthly income of up to PKR 60,000 are eligible.

How can I apply for the loan?

You can apply through the official website or visit the near Tehsil Office.

What documents are required for applying?

You need a CNIC, proof of income, proof of house, and property details or structure plans.

How long is the repayment period?

The payment period ranges from 5 to 10 years.